Consultants, here’s how to make your money work harder!

Putting in place certain practices can change your financial perspective and confidence

In our last post, we discussed the key considerations to keep in mind when making the shift to independent, insight-related consulting. These were:

- Developing expertise

- Executing your insight projects efficiently

- Thinking of your consulting practice through a micro-entrepreneurship lens

- Securing repeat customers

- Managing your income and savings prudently

In the next series of posts, we will delve deeper into these areas. For starters, we will address a topic we are quite enthusiastic about and that a lot of us struggle with. Savings! It’s also a relevant topic because ongoing global uncertainties can affect your savings in 2022 in two key areas: debt and equity.

Before we get into it, let’s examine your life as a consultant. It’s a new normal. You don’t get a regular salary credit like before. But, at the same time, your expenses don’t stop knocking on your door! There are even large annual expenses like a child’s education or a parents’ medical bill. In such a scenario, managing cash flows is a key ingredient of a stress-free life as a consultant. How can you manage cash flows effectively?

A simple Google search will give you plenty of ideas. But it’s also an ocean of technical terms. We’re going to simplify it for you. By anchoring this whole discussion around two simple concepts that we personally find very useful while managing cash flows.

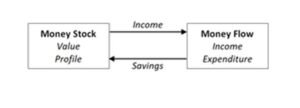

They are Money Stock (Investments) & Money Flow (Income & Expenditure).

What is Money Stock?

Money stock can be financial like a fixed deposit, or it can be invested in assets like real estate or gold. Why is it important? It creates solidity and security. It provides a base for everything you do. And so, it’s important to keep track of it. An activity that has helped one of our co-founders is maintaining an Excel sheet that lists all elements of the money stock. This can be savings accounts, investments, real estate, or any other item. It also helps to create a classification of the elements based on their risk profile (equity, debt, other asset classes). An Excel sheet like this allows our co-founder to track savings, their growth, and their risk-return profile every six months. What’s the advantage of doing this?

- It brings discipline to managing your investments.

- It allows tracking of how well you are (hopefully!) growing your savings.

- It helps you understand the risk-to-return profile of your savings, and take appropriate action. For example, are you too conservative, too aggressive, or just right? Are you taking advantage of rising markets or missing out?

- It provides a solid footing to take subsequent prudent steps. For example, making sure each asset has a registered nominee.

Ultimately, it gives you more confidence to make more informed decisions, take calculated risks for growth, and really plan your life!

Track and classify

Financial savings are easy to list and track. In all likelihood, you have online access to them. If you do not have access to a particular financial asset online, the time to get a new one is now! In other cases, you may have to take a different approach. For instance, you should be able to understand the value of real estate assets by referring to online sites that list similar assets.

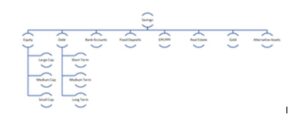

Classification of your savings based on their risk profile is slightly more complicated but can be learned over time. Our co-founder follows the following simple classification.

Explanation of some of the above terms:

- Equity: Savings invested in stocks of companies. These could be direct holdings or mutual funds or any other route. The ‘cap’ refers to the size of the companies.

- Debt: Savings in interest-bearing debt instruments. These could be through mutual funds or direct holdings. The ‘term’ refers to the duration of the debt instrument.

- Alternative Assets: Include non-traditional investments such as Real Estate Investment Trusts (REIT) or Infrastructure Investment Trusts (InvIT).

Why classify? Because it helps you understand the risk-return profile of your investments and modify it over time to suit your needs. For example, you may find that you are too conservative in your investments. As a result, they are not growing fast or earning adequate income. In this case, you can alter your folio to your advantage.

Some of your Money Stock would be giving you income. For example, an apartment gives you rental income or a fixed deposit gives you interest or a stock you own gives you dividends. This brings us to the next concept.

Money Flow (Income & Expenditure)

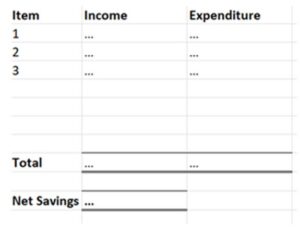

Listing your income and expenditure over a period of a month or a year is a great way to bring discipline into your financial life. If the gap between what you earn and spend is positive, the resulting saving can contribute to your Money Stock. If it is negative, you are consuming your savings.

Our co-founder’s personal practice is to make a simple money flow statement for a month, listing out income and expenditure. Care needs to be taken to include all items and average out income and expenditure that is not monthly in nature. For example, if there is a yearly expense such as a premium to be paid on medical insurance, the same needs to be accounted for by dividing the total amount to be paid by 12. If you do not have insurance (separate article alert!), you also need to account for sudden unforeseen expenses like hospitalization.

Managing this money flow is important, thanks to the variable nature of income as a consultant and the constant nature of expenses.

Depending on personal or family circumstances, the level of uncertainties can vary. To offset this uncertainty, you can plan your investments in a way that they provide a steady income via interest or dividends. You could also park some funds in relatively liquid investments that can be used when necessary. On the expense side, it is prudent to keep expenses as a percentage of your income, and include insurance to take care of unforeseen expenditures.

Putting it all together

With the above in place, your financial perspective and confidence change! You have so much more clarity and control. Now you can have clear answers to key questions that can determine both the health of your consulting practice and your personal well-being. Questions like:

- What is my level of savings?

- What is the risk-return profile of my savings?

- What return am I getting on my investments?

- Given the risk, are my investments giving me an adequate return?

- Do I earn more than I spend?

- Can I cover sudden, unforeseen expenses?

- Will I be able to meet my goals like buying or constructing my own house or upgrading to a new car or putting my child through a good college?

Simply being able to answer these questions confidently can give you great comfort! After that, you can fully focus on developing your consulting practice.